Crypto has now become one of the preferred methods for people looking to save or invest the money as trust in traditional finance continues to drop.

Two of the biggest names in the industry are Independent Reserve and BTC Markets, each of them offering different features and benefits that make it easy for users to decide on one.

After reading this guide, you are sure to have a better idea of which exchange will be the best for your needs and why. Let’s get to it!

visit site

visit site

|

| |

|---|---|---|

| About | Independent Reserve is one of the most popular crypto exchanges in Australia and New Zealand with over 150k active customers. | BTC Markets is the other dominant exchange in Australia with over 270k customers, claiming to be the most liquid exchange in the region. |

| Rating | ||

| Cheaper Fees | ||

| Payment Methods | ||

| Direct Deposit | ||

| Credit Card | ||

| PayPal | ||

| Pay ID | ||

| Poli | ||

| Features | ||

| Beginner Friendly | ||

| Mobile App | ||

| Cold Storage | ||

| 2-Factor | ||

| Currencies Accepted |

Independent Reserve

Pros

- Wider support of crypto and fiat currencies.

- The exchange also provides more deposit and withdrawal methods, more accessible to a wider public.

Cons

- more expensive option due to the lower discounts offered.

Independent Reserve is one of the most popular crypto exchanges in Australia and New Zealand with over 150k active customers.

The exchange was founded back in 2013 by Adam Tepper and Adrian Przelozny, two entrepreneurs with years of experience in the software industry who aimed to create the biggest and most trusted Bitcoin Exchange in Australia.

In almost one decade of existence, Independent Reserve has expanded its presence to south-east Asia and gained the trust of over 8000 self-managed super funds.

The company is registered and fully compliant with the Australian regulatory framework as certified by the Transaction Reports and Analysis Centre (AUSTRAC). This provides its users with a high degree of security and trust in the exchange. You can read our full Independent Reserve review here.

BTC Markets

Pros

- high trading volumes

Cons

- less support when it comes to crypto currencies

BTC Markets is the other dominant exchange in Australia with over 270k customers, claiming to be the most liquid exchange in the region. This means that users are able to quickly trade crypto without drastically affecting its value.

The exchange was founded in 2013 by Martin Bajalan, a software development manager who had been working for companies like Autodesk and Amazon before this event.

During its 10 years of existence, BTC Markets has seen over $10.5 Billion in trading, 5 BTC forks, 2 halvings, the ICO craze, and all the ups & downs of the crypto market.

BTC Markets has also become Ripple’s partner for its On-Demand Liquidity program, which allows users to complete cross-border payments in a matter of seconds.

Independent Reserve vs BTC Markets: Exchange Comparison

There are several aspects you should consider when choosing between Independent Reserve and BTC Markets, as no two crypto traders are alike.

Fiat Currencies Accepted

The first thing you should look at is what Fiat currencies are accepted by the exchange, as this will ensure you can buy or sell crypto with your preferred currency.

Buying and selling crypto with your preferred Fiat Currency is just as important as the options you can acquire.

Independent Reserve is the clear winner for this category as it supports AUD, NZD, and USD, while BTC Markets only supports AUD. This creates new investment opportunities for users looking to have more control over which currency to pay or withdraw with.

🏆 Winner: Independent Reserve

Independent Reserve supports AUD, NZD, and USD, while BTC Markets only supports AUD.

Cryptocurrencies Accepted

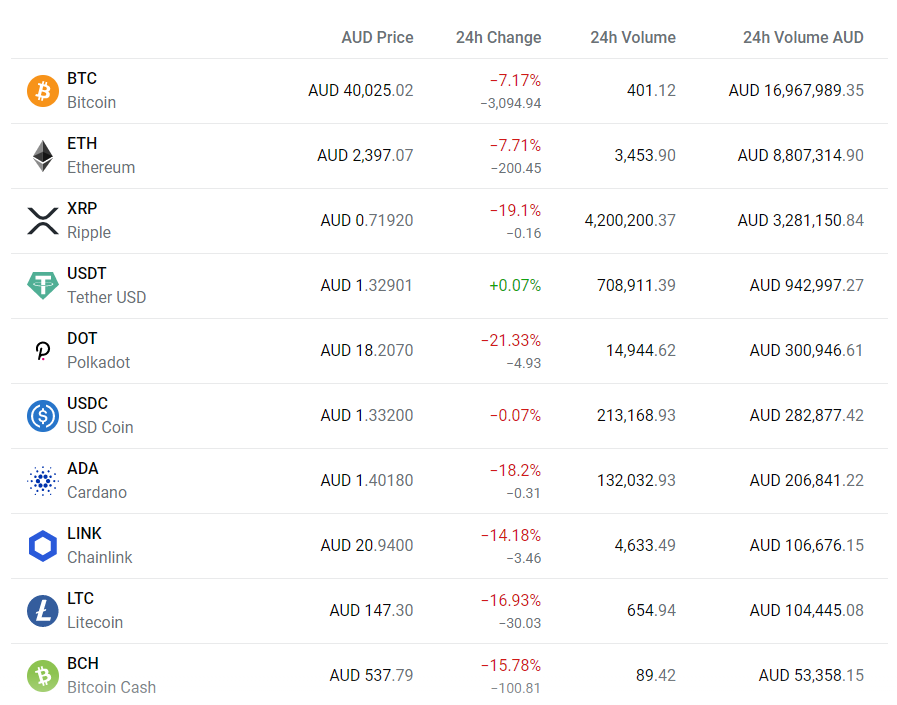

Looking at the cryptocurrencies supported by the exchanges is another aspect that needs to be addressed. In this case, both exchanges support popular cryptocurrencies such as BTC, ETH, BAT, COMP, LINK, and OMG.

BTC Markets supports 15 cryptocurrencies at this time while Independent Reserve supports 20, making the latter the best option for most users.

The differences between the offerings of both exchanges are USDT, USDC, MKR, DAI, SNX, EOS, PMGT, and ZRX being offered by Independent Reserve, while BTC Markets offers POWR and ENJ.

This makes Independent Reserve the better option unless you are looking to invest in POWR or ENJ, at least when it comes to supported Fiat and Crypto Currencies.

🏆 Winner: Independent Reserve

Independent Reserve the better option unless you are looking to invest in POWR or ENJ, at least when it comes to supported Fiat and Crypto Currencies.

Deposits

For deposits, Independent Reserve allows its users to deposit using PayID, Osko, and POLi, as well as Bank (SWIFT), Electronic Funds, and crypto Transfers.

BTC Markets offers BPay, Osko, and crypto transfers.

Deposit methods like PayID, Osko, and Pol allow users to quickly access the crypto market without the need of relying on traditional banking transactions, one of the fundamental principles of cryptocurrencies.

On the other hand, being able to transfer cryptocurrencies from other wallets or exchanges will allow for quick transfers of funds in case you want to invest in a currency not available on other exchanges, as well as providing all the benefits of crypto transactions.

🏆 Winner: Independent Reserve

Independent Reserve allows its users to deposit using PayID, Osko, and POLi, as well as Bank (SWIFT), Electronic Funds, and crypto Transfers.

Fees

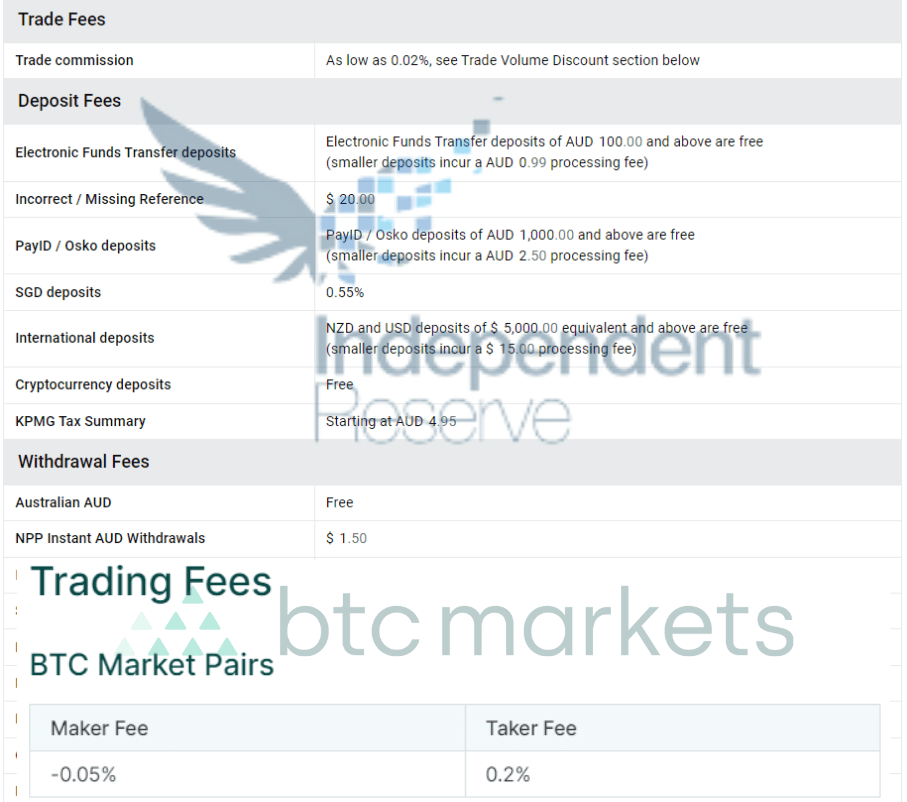

BTC Markets has no depositing fees, however the deposit methods are limited. Independent Reserve, on the other hand, charges for some deposits depending on the method used and the amount deposited.

In terms of trading fees, you will find Independent Reserve to be the winner if you are aiming to invest less than 70k AUD in a period of 30 days, as the discounts for BTC Markets will be higher at this point.

For example, if the trading volume in the last 30 days was 200k AUD, a user would be paying 0.44% in fees to Independent Reserve or 0.65% to BTC Markets.

Fees will vary depending on different factors such as deposit and withdrawal methods, as well as the currencies involved, trading volume, and trading pairs, so in this case, it would be recommended for you to check and compare while keeping in mind your specific situation.

👔 Winner: Tie

Both Fees will vary depending on different factors such as deposit and withdrawal methods, it would be recommended for you to check and compare while keeping in mind your specific situation.

Security Features

Now, security is everything when it comes to crypto investing and these two companies are aware of that.

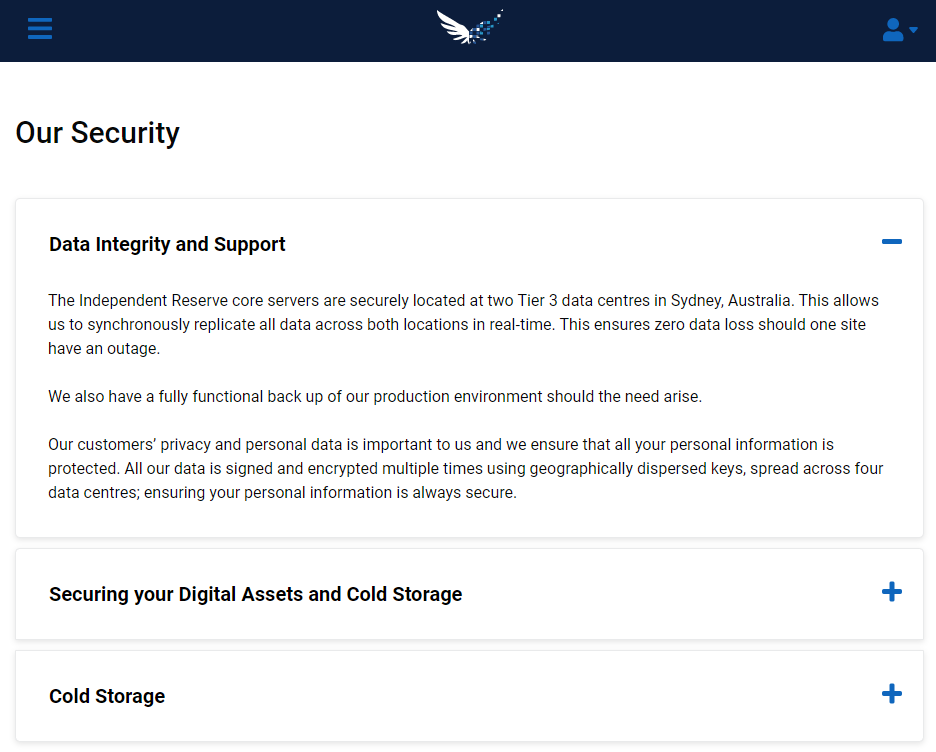

Independent Reserve makes use of servers located at two tier-3 data centres in Sydney that allow for the constant syncing of information, a full backup of the production environment, and complete data encryption using geographically distributed keys.

The exchange also uses Cold Storage to store the majority of the crypto assets, protecting them with multiple layers of biometric authentication and physical security in different locations.

Cold storage means that the information is stored in a physical device not connected to the internet, which provides an extra layer of security as hackers won’t be able to access it remotely.

🏆 Winner: Independent Reserve

Independent Reserve uses Cold Storage a physical device not connected to the internet, which protects it from hacking.

Regulation Compliance

Both exchanges comply with local regulations as certified by the Australian Digital Commerce Association, in addition to being registered with the Australian Transaction Reports and Analysis Centre.

👔 Winner: Tie

Both exchanges are certified by the Australian Digital Commerce Association.

Customer service

The exchanges are also similar when it comes to customer service, providing their users with knowledge bases, FAQs, and the option to submit a ticket at any moment if they require further assistance. None of them supports chat or phone calls.

👔 Winner: Tie

None of them supports chat or phone calls.

Pros and Cons of Independent Reserve

The Pros of Independent Reserve are the wider support of crypto and fiat currencies, as this will allow investors to take advantage of a bigger market when it comes to diversifying their portfolios.

The exchange also provides more deposit and withdrawal methods that ensure the trading experience is more accessible to a wider public.

This is accompanied by the lower fees for those users who are looking to have movements of less than 70K AUD monthly, as it will result in lower trading fees when compared to BTC Markets.

If you are looking for an exchange that offers you a better trading rate when investing higher quantities, Independent Reserve will prove to be a more expensive option due to the lower discounts offered by it.

Pros and Cons of BTC Markets

BTC Markets discounted trading fees for high trading volumes are one of its major pros over Independent Reserve, allowing users to pay as low as 0.1% when trading over 5000000 AUD.

The exchange also offers free deposits using all of its methods, which ensures you won’t have to check at the small print before adding AUD into your account’s balance.

However, BTC Markets offers less support when it comes to crypto and fiat currencies, as well as deposit and withdrawal options, which might prove crucial for some users looking to use specific methods.

These two exchanges offer excellent features to both users looking to start investing in cryptocurrencies or seasoned veterans. They are fully compliant with local regulations and have big user bases vouching for them.

By contrasting the pros and cons we have provided with your investment plans and specific needs, you should be able to choose the best exchange for you.

You could even use both of them! After all, investing in cryptocurrencies is a matter of selecting the best methods and times to trade, so make sure to have solid foundations by selecting the exchange that offers you a better deal.

Choosing wisely will allow you to create new investment opportunities, save on fees, and maximize your profit in several ways.

Overall Winner: Independent Reserve 🏆

It’s a close call, but with their wider range of cryptocurrencies, fiat currencies accepted and their easy deposit methods, Independent Reserve comes out on top. For a safe and secure exchange that’s easy to use, sign up to Independent Reserve here.