What to look for in an exchange

Reputation (Security)

Reputation and Security is perhaps one of most, if not the most important metric to look at when evaluating if an exchange is safe to use. As there have been many hacks over the years with exchanges, it’s super important to know what kind of security measures the exchanges use to protect users and their funds.

As a general rule in 2021, if you’re interacting with an exchange, you want to at least make sure they have cold offline storage. What this means is they store the majority of user funds in an offline storage where it’s not exposed to the internet and makes it hard for hackers to get in.

So if an exchange does not have offline storage then we would recommend you to stay away as every second you are on the exchange, you’re being exposed to potential hacks – and remember you will never know when it happens.

Currently the king of security for exchanges is Gemini Exchange – co-founded by the Winklevoss Brothers. They tackle every aspect of security from hackers to inside exploitations to even not giving power to the founders themselves. On the other hand, exchanges you want to avoid are exchanges with no cold storage, anonymous team, bad online reviews and if you type their name on google, general sentiment for the exchange comes up as ‘scams’.

Other risks concerning exchanges are the team themselves. They could one day stop withdrawals on your crypto assets when they want. This has happened multiple times starting with the infamous exchange Mt. Gox and most recently OKEx – a well ‘reputable’ exchange nonetheless. Although fortunately OKEx did enable withdrawals again after a month of silence.

What we at Coin Companion look for:

We look for at least Cold Storage for User funds, 2FA and KYC. This is the bare minimum of security an exchange should have in 2021.

Trading Fees

The next metric to evaluate are the trading fees. You don’t want to pay staggering amounts every time you make a simple trade. Some exchanges have fees so high it feels like a robbery and you wan’t to avoid those exchanges at all costs – Unless they offer air-tight security or other benefits to make up for the high fees.

Fees also comes in different forms and it’s not always as simple as a trade fee. Exchanges often like to hide fees in numerous areas to make it seem like fees are low but in fact if you add it all together it might surprise you.

Common areas to hide fees are deposits, withdrawals and spreads. Withdrawals are easy to include a big fee as most users don’t check the withdrawal fees until they already have cryptocurrencies on the exchange. When you withdraw, you’ll need to pay the base network fee of the crypto but exchanges like to add their fee on top of that.

The other money sucking place is spreads where the price you buy a coin is higher than average. For eg, if BTC trades for $20k on most exchanges, and your exchange trades for $21k… then they are likely hiding a massive fee inside the spreads.

Some exchanges also offer trading fee tiers to entice users to come on to their platform. The way this works is the more volume you trade in 30 days, the lower your fees are. This is great if you do large amounts of trades.

What we at Coin Companion look for:

We look for a combination of fees that come from deposit, withdrawal, trading and spreads and evaluate if those fees make sense for what the exchange offers.

Payment methods

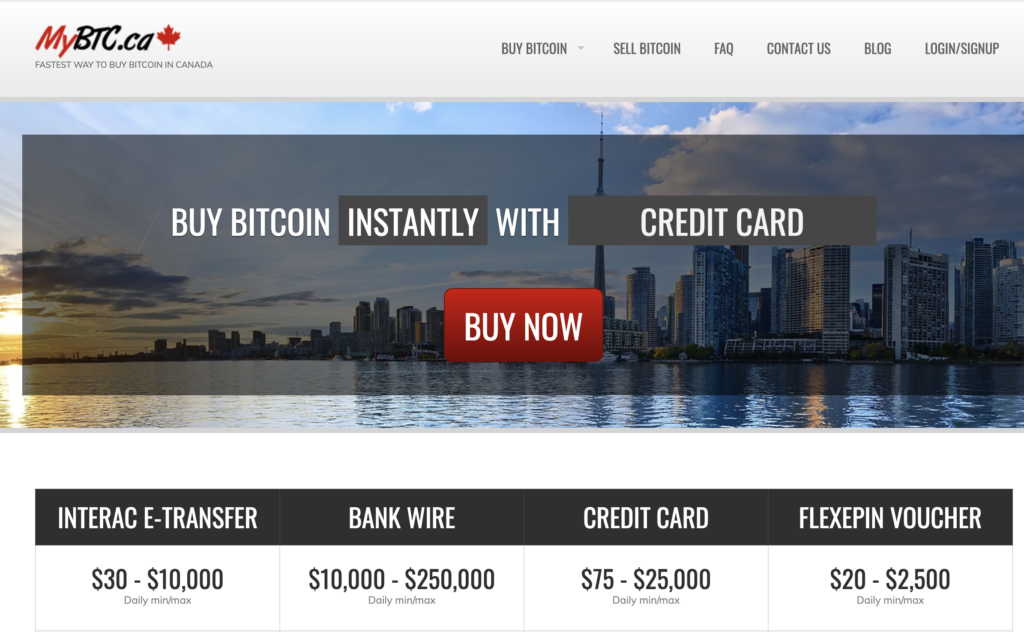

The most common ways of paying and buying crypto nowadays through a Canadian exchange is using Interac e-transfer. It offers the fastest deposit deposit and more often than not, zero fees associated with the method.

Should you need to deposit a large sum of money at once, oftentimes exchanges will offer a Bank Wire method for you to use.

What we at Coin Companion look for:

The exchange needs to have Interac e-transfer as a payment method as that is the cheapest and faster method in 2021.

Verification Process

In 2021, performing Know Your Customer is the norm. Regulations are tightening up on the industry as a whole so if an exchange does not do KYC, then it is a bit risky to use them.

A good KYC process should not take days and days for you to be verified and finally deposit and withdraw.

Some exchanges allow unverified users to deposit and even trade but if you want to withdraw, then you’d need to be verified to do so.

Another system which some exchanges use is a tier system. If you’re unverified, you can potentially deposit and that’s it. Then they would have Tier 1 verification where you only need to submit a light document. And this would open you up to all the other functions of the exchange, but you’ll have daily deposit and withdrawal limits.

At Tier 2, you’ll need to provide more documents and then the exchange will increase your daily limits.

What we at Coin Companion look for:

We look for a fast verification process which does not force users to wait a long time and be too hassled with the documents.

Geographical Restrictions

There are many exchanges which operate globally and there are also exchanges which operate solely in Canada. There are certain advantages when going with a Canadian only exchange compared to a global one.

Canadian only exchanges allow for the cryptocurrencies listed to be paired with CAD directly. This means you don’t need to do conversions of CAD to USD when buying cryptocurrencies and that makes taxes easier to calculate.

It might also be easier to deposit and withdrawal from a Canadian only exchange as are native to the Canadian banking system.

On the other hand, global exchanges can offer more features, security, and coins to buy.

What we at Coin Companion look for:

For ease of use for Canadian cryptocurrency investors, we generally recommend one of the Canadian exchanges such as Bitbuy as they are quite competitive with the global exchanges but are native to Canada.

Exchange Rates

We touched on spreads a little bit in the Fee section but let’s dive a little more into the spreads that we like to look for.

As you know, different exchanges will have different prices of cryptocurrencies. The buy price may be higher and the sell price may be lower. Exchanges do this so they can make profit in addition to the trading fees or lack thereof.

What we at Coin Companion look for:

We generally like to look for exchanges with low and competitive spreads to the general price consensus of the market – but there are exchanges where higher spreads are justified. If they charge no fees in trading, deposits and withdrawals then higher spreads are the only source of income for their service.

Understanding the Types of crypto exchanges

Centralised

Centralised Exchange or CEX refers to all the exchanges run by companies. Binance, Huobi, Gemini are all examples of those. With these exchanges, you are required to provide documents to verify your identity before being allowed to use them.

You’re also trusting that the exchange won’t run away with your crypto as the popular saying goes ‘not your keys, not your crypto“. Exchanges are the best way currently to change fiat into cryptocurrencies.

Decentralised

On the rise lately have been Decentralised exchanges or DEXes. The most popular is Uniswap but there are other ones as well. These exchanges are not run by any companies so you don’t store any funds on them. They are essentially smart contracts on the Ethereum blockchain and you use these DEXes by calling the functions of the contracts.

You just need to connect it to your Metamask account and it will immediately do your trade.

The difference between CEXes and DEXes aside from centralization and lack thereof is the way trade happens.

On CEXes, you may have noticed an orderbook where you’ll have a list of people wanting to buy Token A at a price and a list of people wanting to sell. Then where there is a price agreement, a trade is made.

However, on DEXes, this is not the case. They don’t have a list of people at all. DEXes use a formula known as Automated Market Making or AMM. We won’t get too into the details as it’s just complicated but just know that DEXes will automatically adjust the price based on exact supply and demand and that can instantly execute your transaction.

Trading platforms

Trading platforms focus on derivatives such as futures trading, leverages or even options. Some of these platforms are Derebit and Bybit.

You’re able to use leverage to long or short bitcoin on these platforms. We don’t recommend you use these platforms unless you’re an experienced trader.

Direct trading

Direct Trading or Over The Counter (OTC) refers to buying and selling cryptocurrencies off the market order books.

Two parties will come together and agree on a set price for a bulk of bitcoins. This is done because if a party is buying millions dollars worth of bitcoin, they don’t want to drive up the price. And Vice versa for the sellers.

The big reputable exchanges such as Coinbase or Binance offer OTC trading.

Brokers

Brokers refer to traditional stock broking companies who are offering cryptocurrencies now. The likes of CMC Markets. These companies are heavily regulated because they are already involved in stock trading.