UK Crypto Exchange Fee Comparison

We have compared the fee’s of the top UK exchanges to find out which comes out as the cheapest exchange to use.

visit site

visit site

|

|

visit site

visit site

|

|

| |

|---|---|---|---|---|---|

| Deposit Fee | 2.99% | $0 | $0 | 3.99% | $0 |

| Buy Fee | 0.25% | $0 | 0.16% | 0.50% | 0.10% |

| Sell Fee | 0.16% | $0 | 0.26% | 0.50% | 0.10% |

| Withdrawl Fee | €3.50 | $5 | 1.5% | €0.15 | $0 |

What to Look for in an Exchange

When looking for an exchange to buy, sell and trade crypto with, it’s important to know what to look for, and how to decide if a certain exchange is a good fit for you. Here’s how we decide at Coin Companion.

Reputation (Security)

Like all financial investments, security is of huge importance when it comes to crypto. The reputation and security of an exchange is one of the most important metrics to look at when evaluating if an exchange is safe to use.

As a general rule in 2021, if you’re interacting with an exchange, you want to ensure they have cold, offline storage. This means that they store the majority of user funds in an offline storage where it’s not exposed to the internet and the potential of hacks.

If an exchange does not have offline storage we do not recommend you use it. This is because you’re being exposed to potential hacks – and by the time you know an exchange has been hacked, it will be too late to do anything about it.

What we at Coin Companion look for:

We look for at least Cold Storage for User funds, 2FA and KYC. This is the bare minimum of security for an exchange in 2021.

Trading Fees

Another important aspect to consider are the trading fees. Limiting the fees you pay for a trade can save you hundreds of dollars over the lifetime of your crypto journey.

Some exchanges have fees that are much higher than necessary. Of course, if an exchange with higher fees has greater benefits such as air tight security and great trading graphs, perhaps you are ok with paying a bit more.

Fees also comes in different forms and it’s not always as simple as a trade fee. Exchanges often like to hide fees in numerous areas to make it seem like fees are low however, once you add them all together, it can be quite steep.

Common areas for fees are deposits and withdrawals. You can also consider spreads as a fee, as they will cost you.

Spreads are where the price you pay for a coin is higher than the market average. For example, if BTC trades for $20k on most exchanges, and your exchange trades for $21k, you are getting less bang, or crypto, for your buck.

Withdrawals are easy to include a big fee as most users don’t check the withdrawal fees until they already have cryptocurrencies on the exchange. When you withdraw, you’ll need to pay the base network fee of the crypto but exchanges like to add their fee on top of that.

Some exchanges also offer trading fee tiers to entice users to come on to their platform. The way this works is the more volume you trade in 30 days, the lower your fees are. This is great if you do large amounts of trades.

What we at Coin Companion look for:

We look at the total amount of fees that come from deposit, withdrawal, trading and spreads and evaluate if those fees make sense for what the exchange offers.

Best Crypto Exchange for Withdrawals

Our favourite UK exchange for withdrawals is CEX.io. Not only are the fees reasonable, it’s also a super easy process.

For Mastercard and VISA, Fees vary, but for Skirll (USD, GBP, EUR), it’s just a 1% fee.

When it comes to withdrawing your btc, there’s a withdrawal fee amounting to 0.0005 BTC. This is around 40% lower than the industry average of about 0.000812 BTC per BTC-withdrawal.

The fees charged by CEX.io are in line with, or even slightly below, the global industry averages, making it our choice for withdrawing.

Payment methods

The most common ways of paying and buying crypto nowadays through a United Kingdom exchange is with a bank transfer. It offers the fastest deposit and more often than not, there are zero fees associated with the method.

What we at Coin Companion look for:

The exchange needs to have a fast and simple payment method that is also affordable.

Verification Process

In 2021, performing Know Your Customer is standard. Regulations are tightening up on the industry as a whole so if an exchange does not do KYC, you should steer clear.

A good KYC process should not take days and days for you to be verified and finally deposit and withdraw. In 2021, most will happen on the same day.

Some exchanges allow unverified users to deposit and even trade but if you want to withdraw, then you will need to be verified.

What we at Coin Companion look for:

We look for a fast verification process which does not force users to wait a long time to start trading.

Geographical Restrictions

There are many exchanges which operate globally and there are also exchanges which operate solely within the UK. As always, there’s pros and cons with each option.

UK-only exchanges allow for the cryptocurrencies listed to be paired with GBP directly. This means you don’t need to do conversions of GBP to USD when buying cryptocurrencies and that makes taxes easier to calculate.

It might also be easier and faster to deposit and withdraw from a United Kingdom only exchange as they are native to the United Kingdom banking system.

On the other hand, global exchanges can offer more features, security, and coins to buy.

What we at Coin Companion look for:

For United Kingdom cryptocurrency investors, we generally recommend one of the United Kingdom exchanges, however global exchanges such as CEX.IO are great for the UK.

Exchange Rates

We touched on spreads a little bit in the Fee section but let’s dive a little more into the spreads and what we look for.

As you know, different exchanges will have different prices of cryptocurrencies. The buy price may be higher and the sell price may be lower. This is the spread. Exchanges do this so they can make profit in addition to the trading fees or lack thereof.

What we at Coin Companion look for:

We generally like to look for exchanges with low and competitive spreads to the general price consensus of the market. Of course there are times when higher spreads are justified. If they charge no fees in trading, deposits and withdrawals then higher spreads are the only source of income for their service.

Understanding the Types of crypto exchanges

Centralised

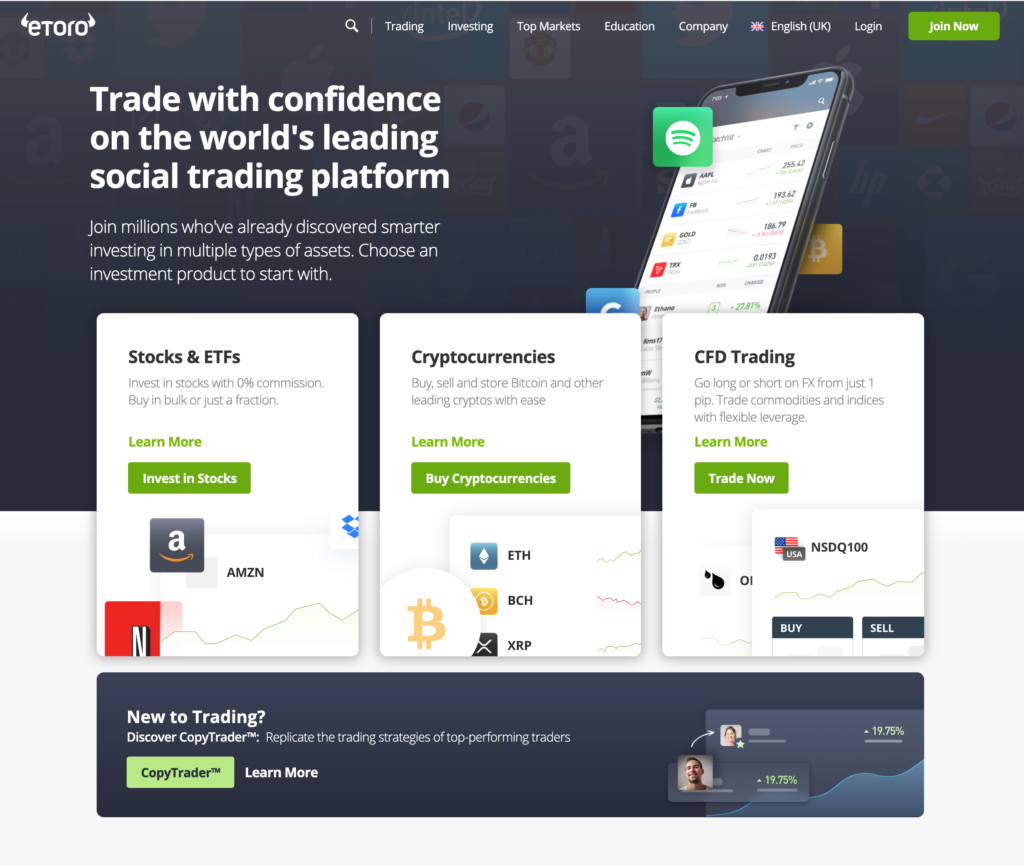

Centralised Exchange or CEX refers to all the exchanges run by companies. Binance, CEX.IO, Gemini are all examples of those. With these exchanges, you are required to provide documents to verify your identity before being allowed to use them.

You’re also trusting that the exchange won’t run away with your crypto as the popular saying goes “not your keys, not your crypto”.

Decentralised

Decentralised exchanges or DEXes have begun to gain popularity. The most popular is Uniswap but there the amount continues grow. These exchanges are not run by any companies so you don’t store any funds on them. They essentially are a blockchain program that exchanges cryptos.

It’s important to note that you need to connect a compatible wallet to use a DEX.

On CEXes, you will notice an orderbook where you’ll have a list of people wanting to buy or sell a Token at a certain price. When there is a price agreement, a trade is made.

However, on DEXes, this is not the case. They don’t have a list of people at all. DEXes use a formula known as Automated Market Making or AMM. We won’t get too into the details as it’s quite complicated but just know that DEXes automatically adjust the price based on exact supply and demand. This makes for fast trades.

Trading platforms

Trading platforms focus on derivatives such as futures trading, leverages or even options. Some of these platforms are Derebit and Bybit.

Unless you are an experienced trader, we typically recommend avoiding these types of trades as they can get quite complicated and will increase your risk.

Direct trading

Direct Trading or Over The Counter (OTC) refers to buying and selling cryptocurrencies off the market order books.

Two parties will come together and agree on a set price for a bulk of bitcoins. This is done because if a party is buying millions dollars worth of bitcoin, they don’t want to drive up the price. And Vice versa for the sellers.

Today, most reputable exchanges such as Coinbase or Binance offer OTC trading.

Brokers

Brokers refer to traditional stock broking companies who are offering cryptocurrencies now. The likes of CMC Markets. These companies are heavily regulated because they are already involved in stock trading.