eToro is a multi-asset trading platform based in the U.K. that was founded in 2007. The company boasts more than 17 million users across 100 countries.

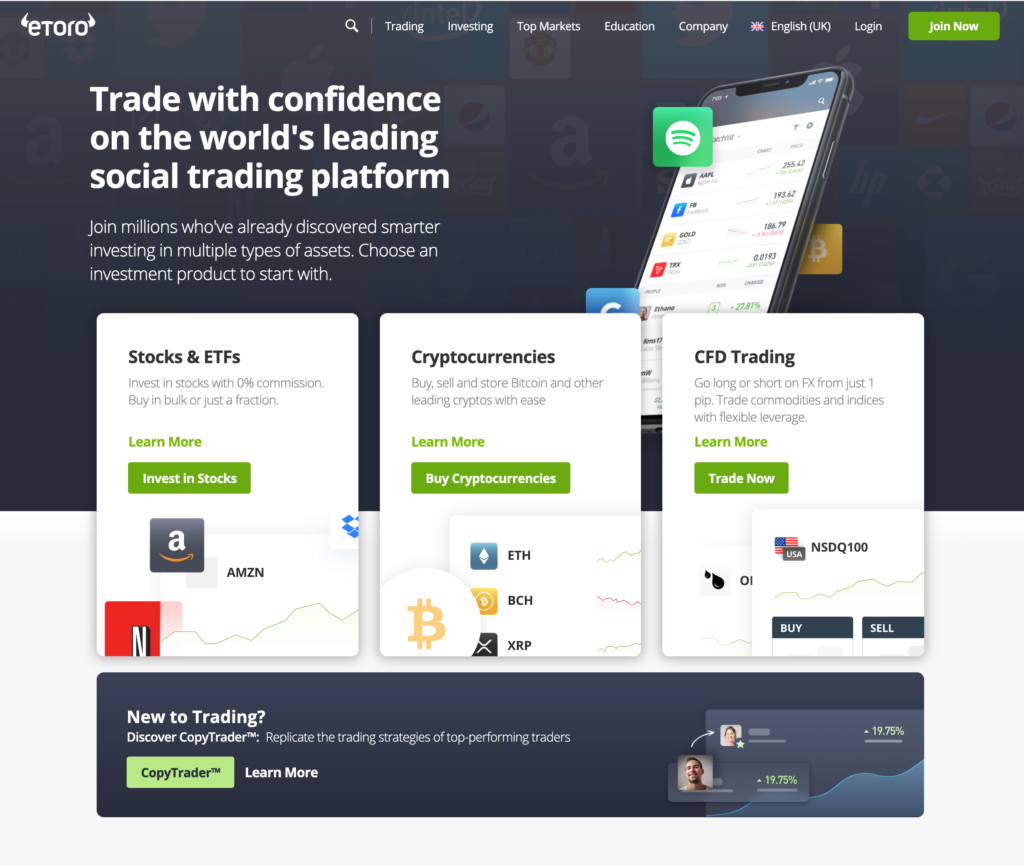

At eToro, you can trade Contract for Differences (CFDs) of popular stocks, commodities such as oil, indices, and 17 major cryptocurrencies such as BTC, ETH, XRP, and LTC, among others and many more trading options.

The major highlight of eToro is its social trading feature. Using this feature, you can copy the trades of successful investors on eToro. Not only that, but you can also interact with your favourite traders on the platform. Plus, you can create a custom news feed to keep a close tab of your preferred crypto assets.

That’s eToro in a nutshell.

Keep reading to get a more detailed review about eToro. We will cover everything – fees, sign-up process, security measures, supported currencies, and much more.

How to use eToro?

Sign up

- Go to www.eToro.com and click on ‘Join Now’

- Once you hit ‘Join Now,’ an electronic form will appear. Enter all the personal data requested in this form.

- Review your entered details and read eToro’s Terms and Conditions as well as their privacy policy. Give your agreement for the terms and conditions by checking the box.

- Click the Sign-up button to submit your information.

- You need to provide a Confirmation of Residency and Proof of Identity for the mandatory KYC process.

Further, eToro will ask you to fill a questionnaire that includes queries regarding your income level, investment goals, risk appetite, financial liquidity, etc.

Buy & sell crypto on eToro

How To Buy?

- Search for the cryptocurrency you would like to trade using the ‘Trade Markets’ tab or the search bar.

- Once you select a cryptocurrency, hit ‘Trade.’

- Insert the amount of cryptocurrency you wish to purchase and select ‘Open Trade.’ That’s it; you have acquired the underlying asset. eToro will buy and hold the crypto on your behalf.

How To Sell?

- Open your portfolio by clicking on ‘Portfolio.’

- Click on the red ‘X’ icon next to the crypto asset you wish to sell. If you are using the eToro mobile app, swipe left on the position you want to close and tap on the red X icon.

- Select ‘Close Trade.’

Is eToro Safe?

eToro is safe as the exchange is fully regulated and licensed by the relevant financial authorities in the USA, Europe, U.K., and Australia, thus making it secure.

Talking about the security of your funds, there is no investor protection for the loss of your crypto holdings except in certain situations. For losses associated with cryptocurrency CFDs, cash, and securities, non-professional investors can claim up to EUR 20,000 or more depending on the regulatory protections. Also, eToro offers private insurance purchased from Llyod’s of London, which provides you with a cover of up to 1 million GBP/Euro/AUD.

It wouldn’t make our list of best exchanges if we didn’t believe it was safe and secure.

How Does Buying Crypto on eToro Work?

As we mentioned, on eToro you trade Contract for Differences (CFDs).

For those who don’t know, CFDs are financial agreements where the difference between the open and closing trades is cash-settlement. Here, you speculate on the underlying asset rather than owning it.

In short, you can trade cryptocurrencies on eToro by buying and selling cryptocurrencies on the etoroX (eToro’s native exchange) or by trading crypto CFDs.

eToro.com Review and Fees Breakdown

Fiat currencies accepted

eToro supports 19 fiat currencies that include EUR, GBP, NZD, USD, AUD, CAD, HKD, and SGD.

Cryptocurrencies accepted

At eToro, investments are made in CFDs, which imply that you get to speculate on the price of an asset rather than owning it.

The platform supports 17 major cryptocurrencies including –

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Dash (DASH)

- Ethereum Classic (ETC)

- Cardano (ADA)

- IOTA (MIOTA)

- Stellar (XLM)

eToro’s fees

The trading charges at eToro depend on your location and the asset you choose to trade.

The U.S. customers trading Bitcoin with eToro pay a hefty 0.75% fee. For altcoins, eToro charges a 2%-5% fee. Comparatively, eToro charges more than other exchanges in the market. Moreover, the fees aren’t transparent either. Instead, the costs are added to the price while executing the trades.

If you are trading stocks outside the U.S., you don’t need to pay any commission for opening or closing a long position. For short positions, you need to pay a commission of 0.18% of the value of your trade.

What about deposits and withdrawals, you ask?

eToro does not charge you for depositing funds to your account. However, you need to pay a $30 fee every time you withdraw your funds. Further, transferring your funds from your eToro wallet to your wallet incurs a fee.

Other miscellaneous fees include currency conversion fees and account inactivity fees. Non-U.S. customers buying assets other than their native currency on eToro incur a currency conversion fee starting from 50 Pips (percentage in point). The account inactivity fee is $10 per year if your account is inactive for 12 months.

Deposit and Withdrawal methods

Deposit

To start trading on eToro, you need to deposit a minimum of $200 for the first time. After your first deposit, there is a minimum deposit amount of $50.

Also, there are some exceptions. For example, the first-time deposit for people living in Azerbaijan, Georgia, New Zealand, etc., is $1,000. In comparison, Algerian residents need to pay a whopping $5,000 to start trading. And guess what, people living in Israel need to deposit $10,000 to start trading with eToro.

As for the maximum single deposit, it depends on which deposit method you use. For instance, for PayPal and Neteller, the max single deposit is $10,000; for POLi, it is $70,000, and there is no cap on deposits made via bank transfers.

Here’s a list of methods you can use to deposit funds in your eToro account:

- Credit/Debit cards

- PayPal

- Neteller

- Skrill

- Rapid Transfer

- iDEAL

- Klarna / Sofort Banking

- Bank Transfer

- Online Banking – Trustly (E.U. region)

- POLi

Withdrawal

To take out your funds on eToro, you need to withdraw $30 at least.

At eToro, your withdrawal request is processed within one business day. However, the time it takes for you to receive your payment depends on the payment method you use.

eToro provides the following withdrawal methods:

- Asia Online Banking

- China Union Pay

- Credit/Debit card

- Neteller

- PayPal

- Skrill

- Wire Transfer

Security features

As eToro operates in accordance with FCA, CySEC, and ASIC regulations, there are robust security measures to protect your funds and data.

At eToro, your funds are secured in top-tier banks and your data is protected using SSL encryption. Further, eToro also supports Two Factor Authentication (2FA), requiring you to enter a verification code after entering your password to access your account. Most importantly, eToro’s mobile application has a biometric entry feature.

Regulation compliance

As discussed, eToro is fully regulated.

- U.S. – eToro is registered with the Securities and Exchange Commission (SEC) in the U.S.

- Europe – eToro is regulated in Europe by the Cyprus Securities Exchange Commission (CySEC).

- The U.K. – In the U.K., eToro is regulated by the Financial Conduct Authority (FCA).

- Australia – In Australia, eToro is authorized by the Australian Securities and Investments Commission (ASIC).

Customer service

At eToro, customer service is based on your tier level. Typically, the average customer support takes up to 14 days to get you a response.

If you have an account balance under $5,000, you can get online help by submitting a trouble ticket on eToro’s customer service. Once you get the chat link, you can chat with a live customer service agent.

Moreover, if you have an account balance of over $5,000, you get a dedicated account manager. And guess what, once you exceed $25,000 in your account balance, you enter the Platinum Club and higher. Here, you get priority customer support.

Mobile App

eToro offers trading on the go. It has mobile applications for both iOS and Android devices. eToro’s trading experience on mobile apps is similar to their web app. The only difference is that their mobile applications have fewer analytical capabilities when compared to eToro’s web version.

The Verdict On eToro

Thanks to its easy-to-use interface, eToro is the go-to crypto trading application for beginner traders. Coupled with their decent selection of cryptocurrencies and other financial instruments, it makes it worth considering. Nonetheless, the high fees on eToro can be a big turnoff for many.