Where To Buy Bitcoin In The UK?

As mentioned, we have reviewed the top crypto exchanges in the UK and around the world on several parameters, including fees, usability, available cryptocurrencies, additional services, trading experience, etc.

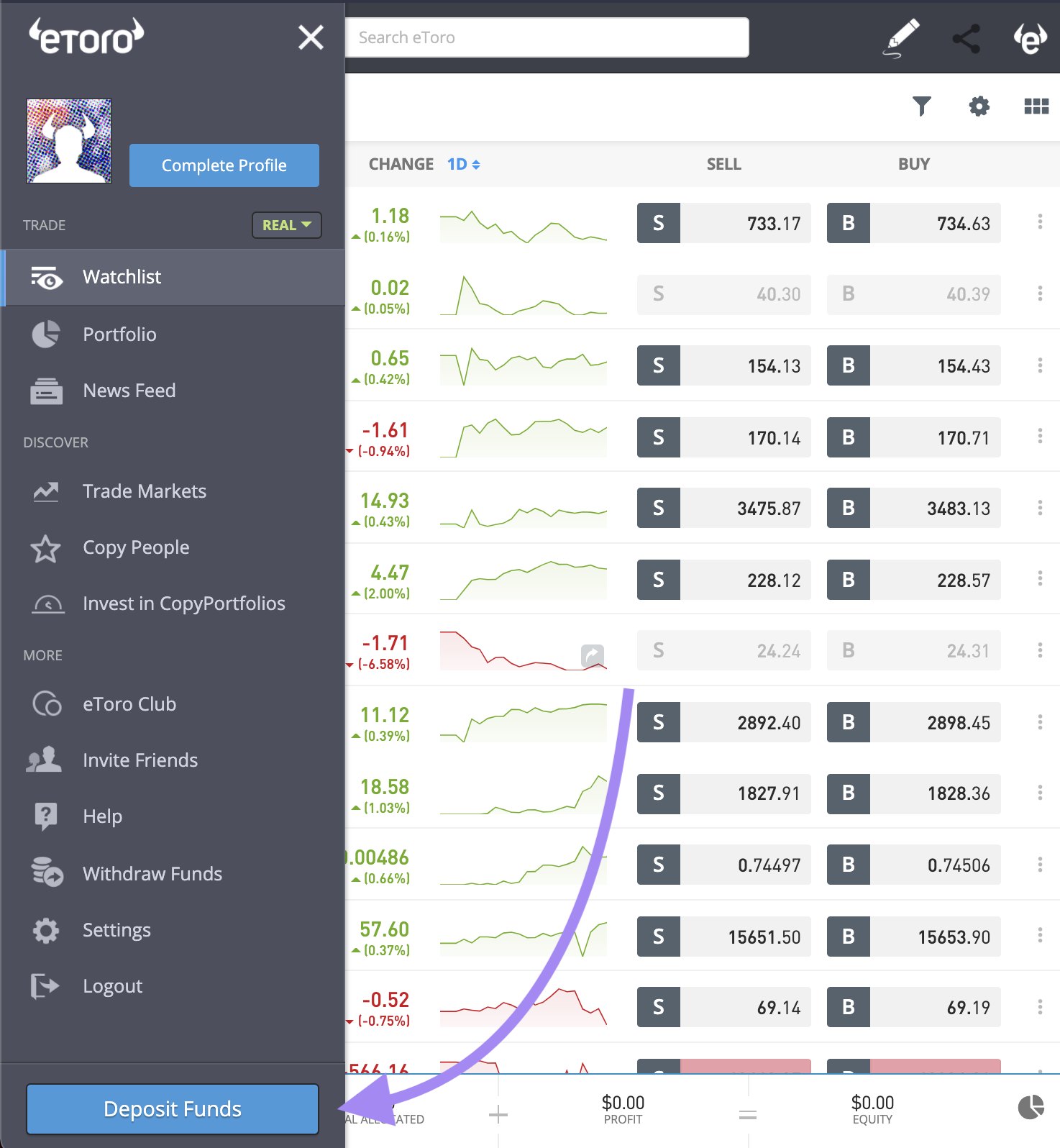

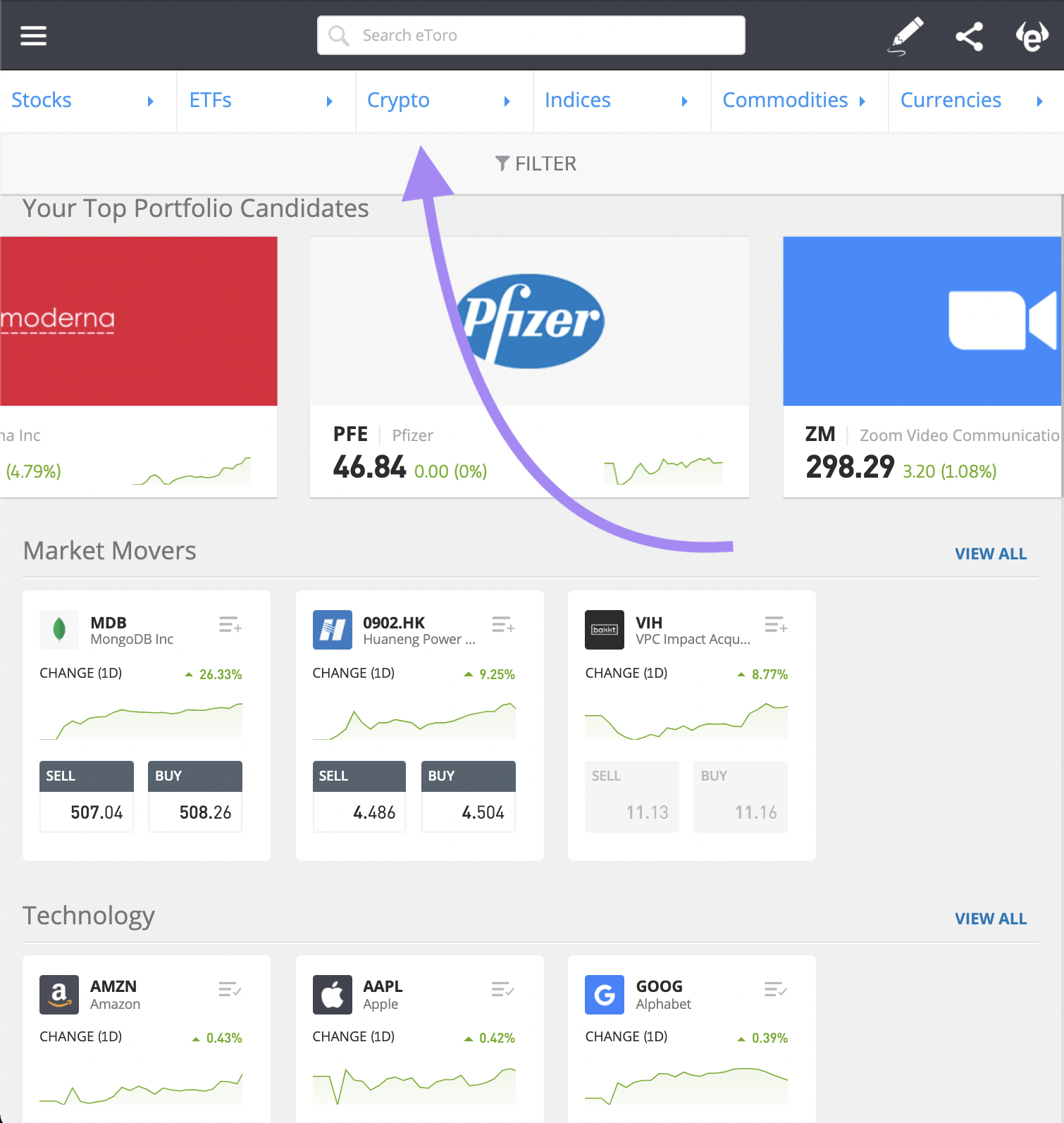

From our research, it is clear that eToro surpasses other crypto exchanges on most parameters. eToro has everything you would look for in a cryptocurrency exchange – it is fully regulated, easy to use, has a wide cryptocurrency selection, high security, free insurance, beginner-friendly features like social trading (you can copy trades of successful traders). It’s no wonder why eToro has a user base of over 20 million across 140 countries.

We would highly suggest you should use eToro to buy or trade Bitcoin in the UK. If you wish to explore other crypto exchanges, you can also use popular exchanges like Coinbase.

How to Pay for Your Bitcoin?

There are several ways to buy Bitcoin. You can pay for Bitcoin using credit/debit cards, Bank Transfer, PayPal, Skrill, and Rapid transfer, among others. And guess what, eToro doesn’t charge you for deposits. However, you need to pay for currency conversion as eToro operates in USD.

For instance, while adding funds in GBP in the UK, your deposit will be automatically converted to USD. This currency conversion will cost you 50 Pips (percentage point). A pip is the slightest price change a given currency exchange rate can make for those who don’t know. Essentially, one pip equals 1/100 of 1%, i.e., 0.0001.

Now that you know the payment methods available and the associated fees on eToro, let’s dive into some of the most popular ways to pay for your BTC purchase in the UK.

Buying Bitcoin With Your Bank Account

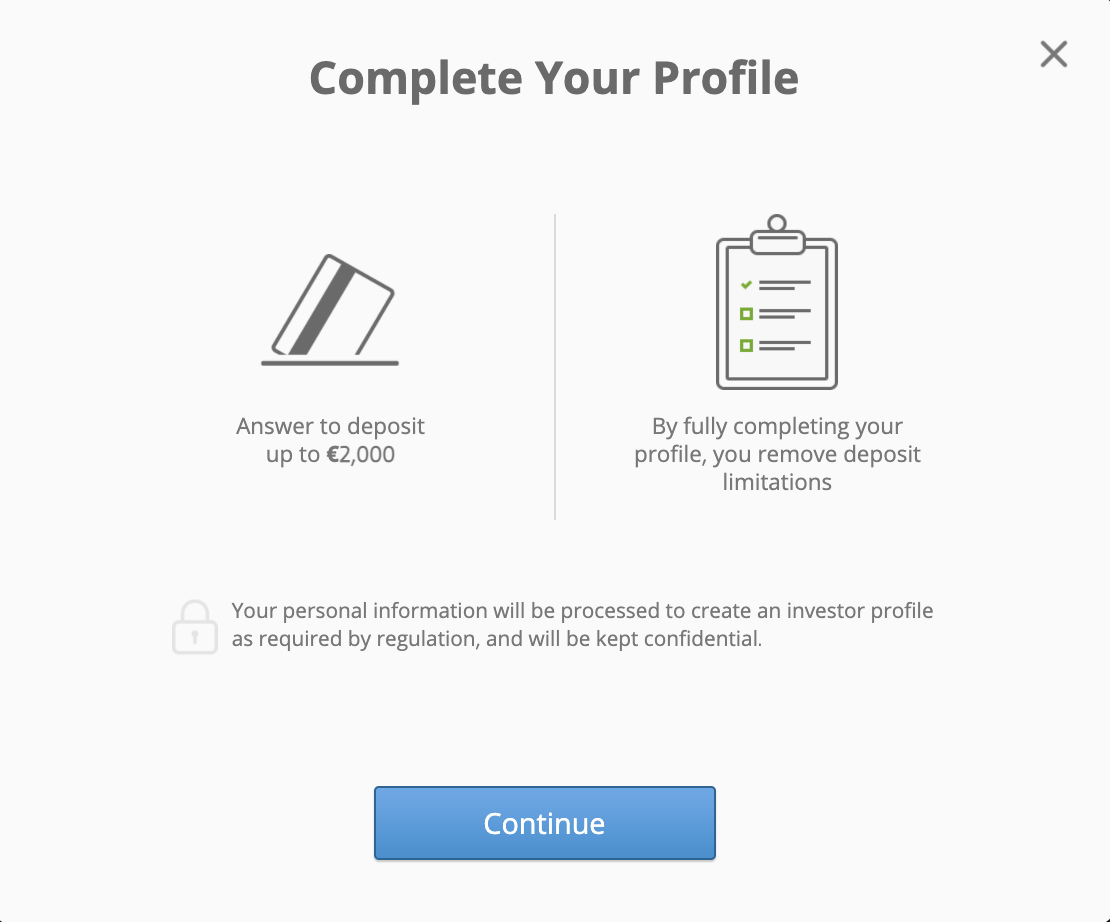

If you’re looking for one of the most straightforward ways to fund your BTC purchase, this is it. Sign up with a crypto exchange in the UK such as eToro, link your bank account, and that’s it; once ID verification is complete, you can deposit using your bank account.

The best part is that with a bank transfer, there is no cap on the maximum deposit on eToro. Also, you can deposit and withdraw using this method. Nonetheless, bank transfers aren’t instant. It takes 4-7 days for the funds to reach your account.

If you love speed (who doesn’t?), you can transfer funds using online banking via Trustly. Don’t worry; there is no additional registration process for this payment method. All you need is to access your online banking account to complete the transaction. Using this method, you can add a maximum of $40,000 in a single deposit.

If you wish to trade with an offshore exchange, you can fund your account using Wire Transfer or SWIFT. However, cross-border payments take up to one week or more.

Buying Bitcoin With a Credit Card or Debit Card

At eToro, you can also use your Visa, MasterCard, Electron, and Maestro credit and debit cards to deposit funds in your account. While using a credit or debit card, you can add up to $40,000 to your eToro account in a single deposit.

The major highlight is that eToro doesn’t charge deposit fees even on credit and debit card purchases. However, you need to pay currency conversion fees.

In comparison, Coinbase has a flat fee of 3.99% per transaction for debit card payments. And that, too, it has a purchasing limit of only $7,500 per week. Another popular exchange in the UK – Coinmama, charges a 5% fee for card purchases.

Buy Bitcoin With PayPal

PayPal is another payment gateway you can use to deposit funds to a crypto exchange in the UK. For this, you need an active PayPal account with sufficient funds on the account balance or a credit/debit card linked to your PayPal account.

With PayPal, you can add a maximum of $10,000 to your eToro account in a single deposit. Well, not only for deposits, but you can also use PayPal to cash out your crypto assets.

Buy Bitcoin With Cash

If you are not a fan of the KYC process and wish to purchase Bitcoin anonymously in the UK, this method is for you.

To buy Bitcoin with cash, you can use peer-to-peer crypto platforms like LocalBitcoins and Paxful. On these decentralized platforms, you can find BTC sellers who accept cash payments. Once you find a good deal, you can meet the person safely and complete the Bitcoin transfer.

Additionally, you can also use a Bitcoin ATM to purchase BTC with cash. It works like a traditional ATM machine. You insert your local currency into the Bitcoin ATM and enter your Bitcoin wallet address. The BTC ATM will then transfer your BTC units to your specified wallet address.

Bitcoin ATMs are mostly located in airports, retail stores, or restaurants. You can use Coin ATM Radar to find one in your area.

The major downside of Bitcoin ATMs is that the price of a Bitcoin is significantly higher at these ATMs when compared to cryptocurrency exchanges.

Buy Bitcoin With Wire transfer.

Wire transfers are essentially used if you wish to deposit a large sum. eToro and other exchanges in the UK support wire transfers. At eToro, the minimum amount for a wire transfer is $500. The maximum is $10,00,000.

While you deposit funds with a wire transfer, the name on your bank wire must match the name on your eToro account.

Buy Bitcoin With Another Crypto

If you have a crypto asset, you can easily trade it for Bitcoin. Yes, cryptocurrency has ‘pairs’ when trading, and the best part is that most cryptocurrencies are paired with Bitcoin.

If you wish to buy Bitcoin with another cryptocurrency, eToro might not be a great option as it has limited crypto-only pairs. For buying Bitcoin with crypto, we suggest you use high-volume exchanges like Bittrex.

Buying Bitcoin With Prepaid Card Or Gift Card

Peer-to-peer (P2P) trading platforms like Paxful and LocalBitcoins allow you to purchase Bitcoin with a prepaid or gift card. All you need is to filter down the sellers that accept these cards. Then, once you find a good deal, you can trade your gift cards for Bitcoin.

Nonetheless, gift cards are valued less than cash as they have limited use. As a result, you won’t find a 1:1 value for your gift card. For instance, your $200 gift card will buy you $100 or less worth of BTC units.

Buy Bitcoin Anonymously

Cryptocurrencies do not provide the level of anonymity they used to in the initial days, all thanks to financial regulations. Nowadays, it is tough to buy Bitcoin anonymously as every exchange platform now requires a KYC.

Don’t worry; there is a way to buy Bitcoin without attaching your identity. The best way to buy BTC anonymously is through a local BTC ATM that doesn’t take your picture while you trade BTC. However, this anonymity comes at a cost. crypto ATMs have high charges.

Additionally, you can also buy Bitcoin from P2P exchanges like LocalBitcoins and Paxful. Here, you can choose to purchase Bitcoin against cash. Nonetheless, purchasing Bitcoin anonymously might get you in trouble while declaring your BTC holdings for filing taxes.

Buying Bitcoin OTC (Over-The-Counter)

When you buy Bitcoin, you contribute to the price movement as prices are essentially dependent on demand and supply. Say you wish to purchase a large sum of BTC units. This will create an imbalance in the market, and the BTC price will move significantly.

To avoid this, institutional buyers prefer over-the-counter trades. Essentially, OTC trades refer to deals that are executed outside a centralized exchange. Here, a seller lists a large sum of Bitcoin at a set price for buyers to purchase. So yes, you can think of OTC trades as peer-to-peer trading on a larger scale.

In short, if you wish to buy large amounts of BTC, you should go with crypto exchanges that provide OTC desks.

Coinbase is one of the major players in the OTC trading space. Moreover, eToro also provides OTC trading. Honestly, Coinbase established itself as one of the OTC leaders after it brokered Mircostrstegy’s purchase of $425 million worth of BTC purchase without moving the Bitcoin market at all.

How to Store Bitcoin

After you have bought Bitcoin, you must ensure that you store it securely. Considering that crypto hacks are on the rise, the safety of your crypto assets is more important than ever.

The last thing you should do is store your BTC units in an exchange wallet. Exchange wallets are the most vulnerable. You should store your Bitcoin on a cold wallet device such as a Ledger or Trezor.

Wait, you might wonder – Bitcoin is a virtual asset. So what are we storing then?

Technically, it would be best if you kept your private keys safe as they give you access to your crypto funds. To store your private keys, you need a crypto wallet. Cryptocurrency wallets are software applications or physical devices that securely manage your private key. These wallets allow you to store, send, and receive cryptocurrencies.

There are three major types of cryptocurrency wallets. Some are best for storing small amounts of BTC units, while others are best suited for storing a significant sum.

Let’s discuss them one by one:

Hot Wallets (Software Wallets)

Hot wallets are software programs that store your private keys on internet-connected devices such as smartphones and computers.

As these wallets are connected to the internet, they cannot be trusted with a large number of Bitcoin. Think of these wallets as your regular wallets where you store enough BTC units for regular trading.

Software wallets are further divided into desktop wallets and mobile wallets. And as their name suggests, the former stores your Bitcoin on your personal computer while the other stores them on your smartphone.

Exodus, Trust wallet, and Metamask are amongst the most reputable hot wallets.

Cold Wallets (Hardware Wallets)

Cold wallets are hardware devices similar to USB sticks that store your crypto assets offline. To initiate transactions, you need to connect these devices to your computer.

Hands down, cold wallets are the go-to option for storing large sums of Bitcoin.

Ledger and Trezor wallets are the most popular hardware wallets. However, considering that personal details of Ledger wallet users were leaked in 2020, we would suggest you consider the Trezor hardware wallet. (The hack didn’t compromise stored crypto assets, only personal data was leaked)

Paper Wallets

A paper wallet is a piece of paper with your private key and public key printed on it as a QR code. To initiate transactions, you need to scan those QR codes.

Comparatively, paper wallets are the safest option. However, they are unfit for frequent transactions as these wallets can only transfer funds in full.

If you wish to try generating paper wallets, you can use WalletGenerator or Bitaddress.

In short, if you store small amounts of BTC for active trading, you should choose hot wallets. Whereas, if you are a long-term investor (HODLer), hardware wallets or paper wallets should be your go-to.

Frequently Asked Questions

Is Bitcoin legal in the UK?

Yes, Bitcoin gained legal status in the UK in 2019. Although there are no specific laws regarding cryptocurrencies in the UK, the government recognizes Bitcoin as ‘property.’

Where can I buy Bitcoin in the UK?

You should buy/sell Bitcoin from exchanges that are licensed by the Financial Conduct Authority (FCA). FCA is in charge of crypto-related activities in the UK.

You can use eToro exchange if you want to buy Bitcoin in the UK, as the FCA regulates it.

How many Bitcoins should I buy?

Bitcoins and other cryptocurrencies are volatile assets. You should only buy Bitcoins that you are willing to lose. In short, buy based on your risk appetite and investment goals.

Do I need to pay taxes on my Bitcoin holdings in the UK?

Yes, Bitcoin is taxable in the UK.

According to the Legal Statement on Crypto Assets and Smart Contracts, Bitcoin is subject to Capital Gains Tax (CGT) or Income Tax (IT). Taxes are calculated depending on the size of your trade and the profits made.

Put simply, if you buy/sell Bitcoin for other assets or trade it to buy goods and services, you need to pay taxes. Also, Bitcoins received as an income are also taxable.

What is the minimum amount to buy Bitcoin in the UK?

The minimum amount of Bitcoin you can buy in the UK differs from platform to platform. For instance, on Coinbase, you can buy a minimum of $2 worth of BTC.

Are there Bitcoin ATMs available in the UK?

Yes, there are currently 166 Bitcoin ATMs in the UK, according to Statista. Mostly, you will find Bitcoin ATMs in places like airports, supermarkets, and restaurants. You can use Coin ATM Radar to locate Bitcoin ATMs in your area.

Which is the best cryptocurrency exchange to buy Bitcoins in the UK?

eToro is amongst the best cryptocurrency exchanges in the UK. Other popular exchanges include Coinbase, CEX.io, and Bittrex, to name a few.

Bitcoin has slowly entered the mass adoption phase, or perhaps it has already gained mass popularity. Everyone is jumping on the Bitcoin bandwagon from whales like Tesla, PayPal, Microstrategy to small retail investors. If you, too, believe in Bitcoin, you can add some BTC units to your crypto portfolio. Nonetheless, Bitcoin is a volatile asset, do your research before diving into Bitcoin waters.

To buy Bitcoin in the UK, choose FCA-regulated cryptocurrency exchanges like eToro. While selecting a crypto platform, you should look for its fees, regulatory approvals, number of cryptocurrencies available, customer reviews, security, and other such factors.

Once you select a crypto exchange, all you need to do is create your account, complete the KYC process, and add funds to your account. That’s it. Now you can buy Bitcoin on that exchange.

Buying Bitcoins is a job half done. You need to ensure you store it securely. You can use cryptocurrency wallets like Exodus, Metamask, and Trust wallet for small amounts of BTC. On the other hand, if you are storing a significant sum of cryptocurrency, hardware wallets should be your go-to.

Now that you know all that goes into buying Bitcoin, don’t wait anymore. Go ahead and make your BTC purchase.