visit site

visit site

|

| |

|---|---|---|

| About | GDAX was launched in 2016. Since then it has been rebranded as Coinbase Pro in May 2018, as it’s a subsidiary of the cryptocurrency exchange Coinbase. | Coinbase was established in 2012 with the goal to bridge the gap between the traditional monetary world and new decentralized economy, bringing easy access to Bitcoin and other cryptocurrencies. |

| Rating | ||

| Cheaper Fees | ||

| Payment Methods | ||

| Direct Deposit | ||

| Credit Card | ||

| PayPal | ||

| Pay ID | ||

| Poli | ||

| Features | ||

| Beginner Friendly | ||

| Mobile App | ||

| Cold Storage | ||

| 2-Factor | ||

| Currencies Accepted | US, EU, UK, CA/SG | US, EU, UK, CA/SG |

GDAX

Pros

- Cheaper fees (dynamic)

- Higher amount of coins

- Currency pairs

- Multiple order types and leverage trading

Cons

- Fewer deposit/withdrawal option

- Complex interface

- For seasoned professionals

Global Digital Asset Exchange or short GDAX was launched in 2016. Since then it has been rebranded as Coinbase Pro in May 2018, as it’s a subsidiary of the cryptocurrency exchange Coinbase. It was developed as a solution for advanced users e.i traders that required a variety of trading tools and features. Coinbase is aimed at ordinary people looking for their first crypto-fiat onramp and is thus more simplistic in manner. This is why they wanted to offer a solution to their existing user-base but also attract new one with the platform on which people can actively trade.

GDAX lets users select between different order types like the limit order, market order, stop order and allow margin trading. Also the platform offers a bigger variety of coins to be traded and has cryptocurrency pairs that include fiat markets, stablecoin markets, altcoin markets and so on.

Coinbase

Pros

- Simplistic approach to buying and selling

- additional deposit/withdrawal options (debit/credit cards)

- Funds are secure and insured

Cons

- Higher fees (static)

- Slightly higher prices

- Can’t deposits cryptocurrency

Based in Silicon Valley, San Francisco, Coinbase was established in 2012 with the goal to bridge the gap between the traditional monetary world and new decentralized economy, bringing easy access to Bitcoin and other cryptocurrencies. Since then, they have grown into a platform serving 35+ million users across 100 different countries, facilitating over $220B in trading.

As a platform aimed at regular users looking to enter and exit this decentralized economy it offers individual coin purchases at aset price. This price is always very close to the price on the freely traded market. Depending on whether you buy or sell cryptocurrencies the price is different. This is called a spread and means that when you buying the price is higher while when you are selling the price is lower.

GDAX vs Coinbase: Exchange Comparison

Since both exchanges are operated by the same company they accept and support the same deposit/withdrawal methods. They can vary depending on the country they operate in and since GDAX is for professional traders it has slightly more options in supported cryptos being traded. This means that you can easily transfer funds between the exchanges once they are deposited.

Fiat currencies accepted:

Both Coinbase and Coinbase Pro (GDAX) support USD, EUR, GBP, CAD, AUD, SGD deposits and purchases in general. The platforms support over 100 countries and where the fiat currency isn’t accepted, it is simply converted to a supported currency.

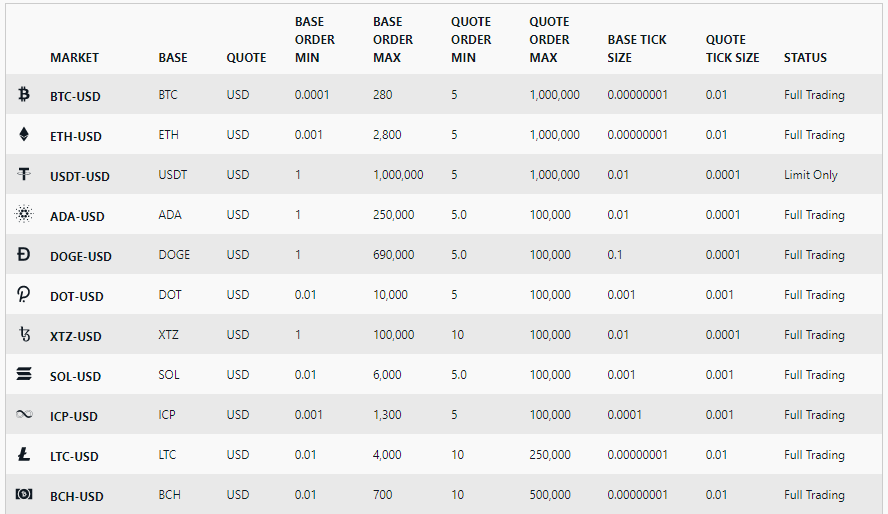

Cryptocurrencies accepted:

Coinbase support purchasing of the following 15 cryptocurrencies:

Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, 0x, USD Coin, Basic Attention Token, Ripple, EOS, Stellar, Augur, DAI, USDC, and Zcash.

Coinbase pro on the other hand support 29 cryptos that can be paired up against each other and against multiple fiat currencies as well:

Bitcoin (BTC), Ethereum (ETH), XRP, Litecoin, Bitcoin Cash (BCH), EOS, Cosmos (ATOM), Basic Attention Token (BAT), Bitcoin SV (BSV), Civic (CVC), DAI, DASH, District0x (DNT), Ethereum Classic (ETC), Golem (GNT), Kyber Network (KNC), Chainlink (LINK), Loom Network (LOOM), Decentraland (MANA), Maker (MKR), Orchid (OXT), Augur (REP), USD Coin (USDC), Stellar (XLM), Tezos (XTZ), Zcash (ZEC), and 0x (ZRX)

🏆 Winner: GDAX (Coinbase pro)

GDAX (Coinbase pro) supports 29 cryptos that can be paired up against each other.

Deposit methods:

Since the same company operates both exchanges they offer the same deposit methods when it comes to fiat currency.

Coinbase deposits can be made via bank transfer using ACH in the US and SEPA in the EU. Other methods involve card deposits with debit or credit.

Withdrawal methods are the same in addition to PayPal.

GDAX supports bank transfers and cryptocurrency deposits and the same goes for withdrawals, so it excludes card transfers.

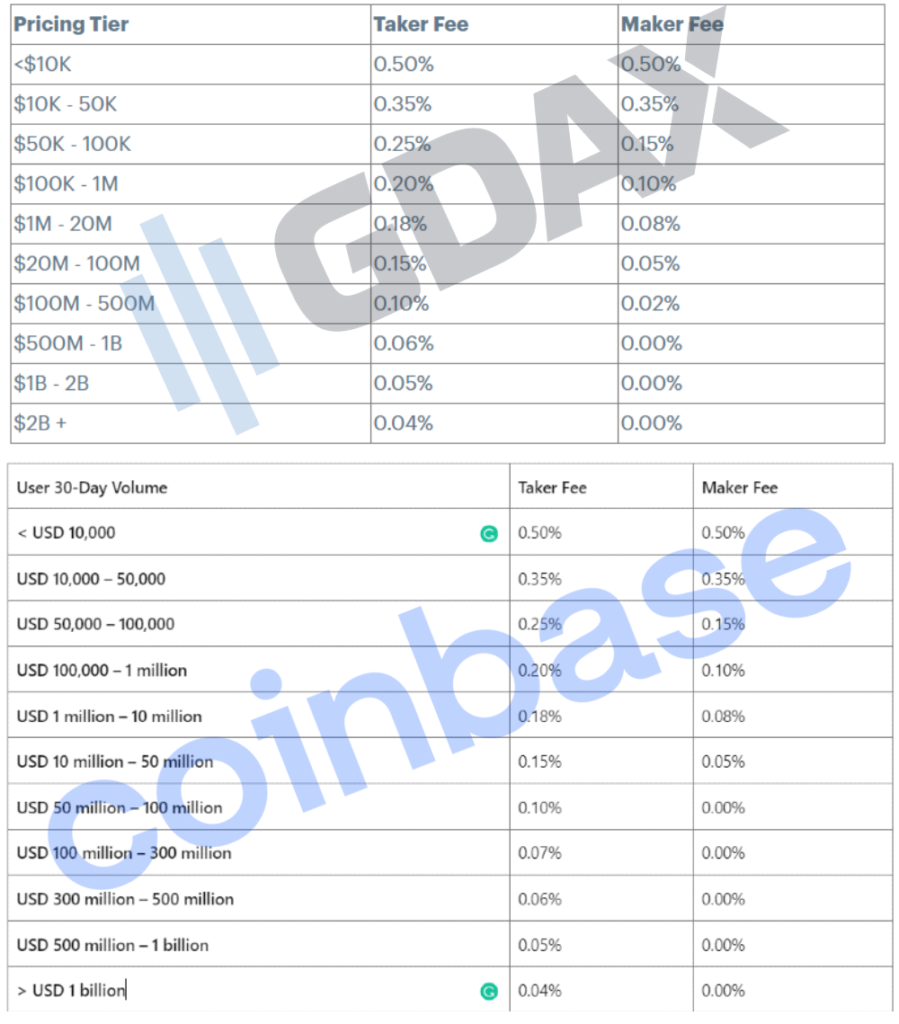

Fees:

Coinbase has a different fee structure from GDAX because of the predetermined price for which the cryptocurrency is bought. GDAX fees vary depending on the volume and the amount.

On Coinbase a fixed fee is applied for purchase below $200, but are also dependant on the purchase amount:

- Up to $10 – $0.99 fee;

- $10 to $25 – $1.49 fee;

- $25 to $50 – $1.99 fee;

- $50 to $200 – $2.99 fee.

The standard fee for a US bank wire transfer is 10$ for deposit and $25 for withdrawal while using ACH method is free. In other countries a percentage fee of 1.49% is applied. Standard debit/credit card purchases have a fee of 3.99%. There are also some variables in this case depending on the location and the amount as well as if you like instant card withdrawal. You can find the full fees and pricing here.

Coinbase Pro (GDAX) has what is called a dynamic fee structure which means that it is more dependent on the frequency and volume. This is to incentivize users and retain native trading. It also varies depending on whether you provide liquidity or take liquidity.

Here is the complete fee structure table for Coinbase Pro.

When it comes to deposits and withdrawals they are free for cryptocurrencies, ACH transfers in the US, Swift for GBP. Standard wire transfer in USD is the same $10/25, for SEPA countries they are 0.15 EUR, while card transfers aren’t enabled. These transfer types depend on the country or region you live in, so for example ACH (Automated Clearing House) is for the US customer, SEPA is for the European Union and Swift is for international transfers.

Also worth noting is that the price of cryptocurrency on Coinbase is calculated by the spot price on Coinbase Pro + 0.5% fee.

🏆 Winner:

Security features:

Besides a standard identity verification, one of the key security component features is 2-factor authentication which you can use with your smart-phone app in order to prevent account hacking and stolen password issues. The other important factor is that it doesn’t hold more than 2% of users funds online, so the other 98% are held in cold storage.

When it comes to fiat currency, US customer’s funds are FDIC insured for up to $250,000. In addition they are held in custodian bank accounts and US Treasuries.

🏆 Winner:

Regulation compliance:

The company behind both exchanges is well regulated in the US and is compliant with the laws of every country it operates in. This is why some of the deposit/withdrawal methods vary in regards to the jurisdiction.

Customer service:

They have a help center where you can find answers to frequently asked questions and browse through their knowledge base.

But if your problem is account specific and you need individual support from a live personnel member, you can contact them through email, form or via a phone number.

Their customer support response time is about 48-72 hours on average, but can take more from time to time because of their large user base, which is why they have made an effort to have all the answers in their knowledge base.

This applies for both exchanges.

👔 Tie

Both has customer support.

Mobile functionality/mobile app:

Both Coinbase and Coinbase Pro have mobile apps for iOS and Android. While Coinbase has an app that is more like a wallet and serves for the purpose of plain buying and selling, Coinbase Pro has an app that allows users to trade with the same experience as on the browser platform.

👔 Tie

Coinbase and Coin Pro have mobile apps for iOS and Android devices.

Pros and Cons of GDAX (Coinbase Pro)

Pros:

- Cheaper fees (dynamic)

- Higher amount of coins

- Currency pairs

- Multiple order types and leverage trading

Cons:

- Fewer deposit/withdrawal option

- Complex interface

- For seasoned professionals

Pros and Cons of Coinbase

Pros:

- Simplistic approach to buying and selling

- additional deposit/withdrawal options (debit/credit cards)

- Funds are secure and insured

Cons:

- Higher fees (static)

- Slightly higher prices

- Can’t deposits cryptocurrency

🏆 The Verdict: Coinbase

Considering what’s been said, Coinbase and GDAX are aimed at users with different needs. This is why Coinbase is better for those that just want to buy Bitcoin and other cryptocurrencies and usually with a smaller amount of capital. On the other hand GDAX is better for traders who know how to utilize different order types, make money on price fluctuations and usually trade in higher volume and capital amount.