There are many exchanges in the crypto industry today but in this review article, we’re going to review two of the oldest and largest Australian exchanges which were founded in 2013.

We’ll compare everything you need to know to choose the best and safest exchange for you.

visit site

visit site

|

| |

|---|---|---|

| About | CoinSpot is one of Australia’s most used and trusted exchanges. | BTC Markets was founded in 2013 by Martin Bajalan and can safely boast that the Australian exchange has not been hacked or have any user funds lost or stolen to this date. |

| Rating | ||

| Cheaper Fees | ||

| Payment Methods | ||

| Direct Deposit | ||

| Credit Card | ||

| PayPal | ||

| Pay ID | ||

| Poli | ||

| Features | ||

| Beginner Friendly | ||

| Mobile App | ||

| Cold Storage | ||

| 2-Factor | ||

| Currencies Accepted | AUD | AUD |

CoinSpot

Pros

- CoinSpot trusted exchange in Australia.

- Coinspot easy to deposits.

- CoinSpot is excellent with tight security.

Cons

- CoinSpot is generally higher than global exchanges.

- The fees are a lot as well.

CoinSpot is one of the largest Australian exchanges founded in 2013 by Russell Wilson. Russell’s mission for CoinSpot was to create an exchange which Australians can use easily and securely invest in cryptocurrency. Since then, CoinSpot has been and still is the safest exchange in Australia.

BTC Markets

Pros

- BTC Markets developers can use to automate trading.

Cons

- BTC Markets don’t have many cryptocurrencies listed.

- Never uses modern deposit systems such as PayID and POLi

- BTC Markets is a dated exchange with lackluster security protocols and measures.

BTC Markets was founded in 2013 by Martin Bajalan and can safely boast that the Australian exchange has not been hacked or have any user funds lost or stolen to this date.

CoinSpot vs BTC Markets: Exchange Comparison

Fiat currencies accepted:

Both exchanges are intended only for Australian investors to use so the only Fiat currency accepted is AUD.

👔 Tie Winner: CoinSpot and BTC Markets

Both exchanges are intended only for Australian investors.

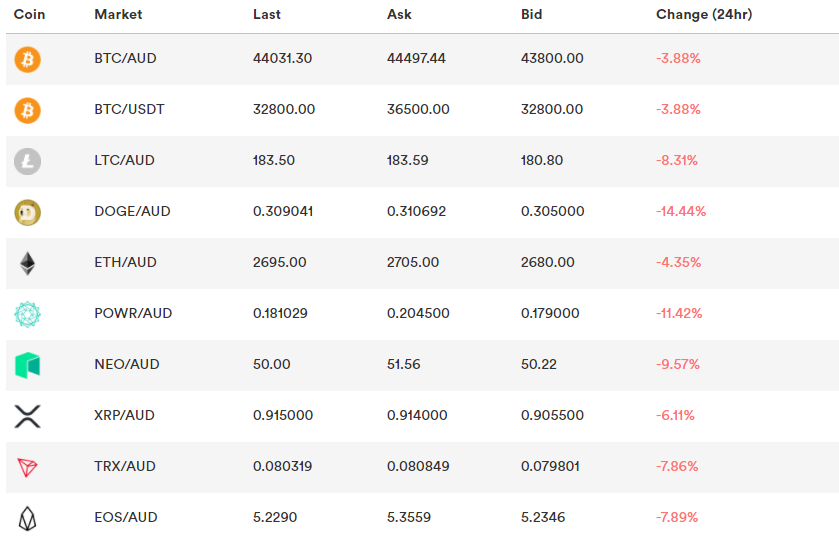

Cryptocurrencies accepted:

Coinspot accepts over 150+ different cryptocurrencies.

BTC Markets accepts only 18 cryptocurrencies – BTC, LTC, ETH, ETC, XRP, OMG, POWR, BCH, BAT, GNT, XLM, ENJ, LINK, BSV, COMP, ALOG, MCAU, USDT.

🏆 Winner: Coinspot

Coinspot accepts over 150+ different cryptocurrencies.

Deposit methods :

CoinSpot offers 5 different deposit methods – POLi, PayID, BPAY, Cash Deposit and Direct Deposit.

Deposits using POLi and PayID is near instant to confirm into your account with zero deposit fees. The deposit limit per day is $2000 for an unverified account and $20k for a verified account.

BPAY can take 0-2 business days to clear and has a fee of 0.9% with a $10k daily deposit limit.

With Cash deposit, you can use one of the thousands of participating newsagents to deposit cash because of CoinSpot’s partnership with BlueShyft.

And finally, with Direct deposit, you are utilising OSKO so deposit into CoinSpot’s bank account. Fees are zero and confirmation is near instant.

BTC Markets offers two deposit methods – OSKO and BPAY. The BPAY deposit limit is $2,000 per day and OSKO is $10,000 per day.

OSKO will take a few minutes to clear into your account and BPAY could take 1-2 business days.

🏆 Winner: CoinSpot

CoinSpot offers 5 different deposit methods – POLi, PayID, BPAY, Cash Deposit and Direct Deposit.

Fees:

CoinSpot fees for buying and selling cryptocurrencies is 1%. The withdrawal fees on CoinSpot are typically higher than other exchanges. It will cost you $10 to withdraw your bitcoins.

BTC Markets fees for buying and selling starts at 0.85% but gradually goes down if you have a high 30-day trading volume. The withdrawal fees are also higher than other exchanges and it cost approximately $10 to withdraw bitcoins. However, some coins like ETH will cost more to withdraw compared to CoinSpot.

🏆 Winner: CoinSpot

CoinSpot fees for buying and selling cryptocurrencies is 1%. The withdrawal fees on CoinSpot are typically higher than other exchanges.

Security features:

Coinspot has completed stringent security audits by SCI Qual International (Audited companies such as Hays, Queensland Government, Krispy Kreme). Coinspot has been awarded ISO 27001 Certification to confirm their security protocols meets a prestigious level of unauthorised usage, damage, tampering and hacking prevention.

They store the majority of user funds in offline cold storage as well. Not many Australian exchanges do this. CoinSpot heavily invests in its security protocol to make sure it is extremely safe for investors to use.

BTC Markets has not been hacked since its launch in 2013 but seriously lacks key security features used in the industry nowadays. They don’t have cold storage available, meaning all user funds are stored in their wallets which are connected to the internet. This means there is potentially a way for hackers to access the funds.

🏆 Winner: CoinSpot

CoinSpot takes their security safely and has been awarded Certification to assure their security protocols meets a prestigious level of hacking prevention.

Regulation compliance:

Both CoinSpot and BTC Markets are registered with Anti-Money Laundering and Counter Terrorist Financing Laws (AML/CTF).

👔 Tie Winner: ConSpot and BTC

CoinSpot and BTC Markets are both registered with Anti-Money Laundering and Counter Terrorist Financing Laws.

Customer service:

CoinSpot offers a multitude of ways to contact their support team. You can call them if you wish to speak to a live agent. Or if you prefer, you can submit a ticket and get your query answered. You can also look at their FAQ documentation sections as well.

BTC Markets does not offer a phone line. They do have a ticket system as well and also a FAQ documentation section.

🏆 Winner: CoinSpot

CoinSpot offers a multitude of ways to contact their support team.

Mobile functionality/mobile app:

CoinSpot does have a mobile app available for both Google Play Store and the Apple Store. It is currently sitting on 3 stars on Google and 5 Stars on Apple.

BTC Markets does not have a mobile app.

🏆 Winner: CoinSpot

CoinSpot app for mobile is available for both Google Play Store and the Apple Store.

Pros and Cons of CoinSpot

CoinSpot is the most trusted exchange in Australia for a reason – the focus on seamless user experience and willingness to get all sorts of security certifications has set them apart from the rest. The amount of different coins available to buy also makes it attractive for Australian investors to be on.

Coinspot also allows for quick and easy feeless deposits so it’s not a hassle waiting for funds to clear.

The cons of CoinSpot are the spreads and fees. The spreads on CoinSpot is generally higher than global exchanges like Binance. The fees are a lot as well and it adds up when you lose 1% at buy in, and a few extra dollars when you withdraw your cryptocurrency.

Other than that, CoinSpot is excellent with tight security measures to grant investors some peace of mind.

Pros and Cons of BTC Markets

BTC Markets does not really have any pros which outshine CoinSpot. Every Pro of BTC Markets is already covered by CoinSpot. The only difference is the public API offered by BTC Markets developers can use to automate trading.

The cons of BTC Markets is that they don’t have many cryptocurrencies listed and they don’t use modern deposit systems such as PayID and POLi. The fees are pretty much the same as CoinSpot – which is already higher than normal.

BTC Markets is a dated exchange with lackluster security protocols and measures. We do not recommend BTC Markets at all.

Overall Winner: CoinSpot 🏆

CoinSpot is one of Australia’s biggest and most trusted exchanges to buy bitcoin and other cryptocurrencies. Signing up is easy, depositing money is simple and the exchange meets all the regulations to give users peace of mind.